Redefining Client Engagement for Modern Wealth Management

In wealth management, trust is your most valuable asset. It is built through consistent, transparent, and secure communication. In today's digital world, clients expect to interact with their advisors seamlessly across the channels they use every day, from email and messaging apps to social media and SMS.

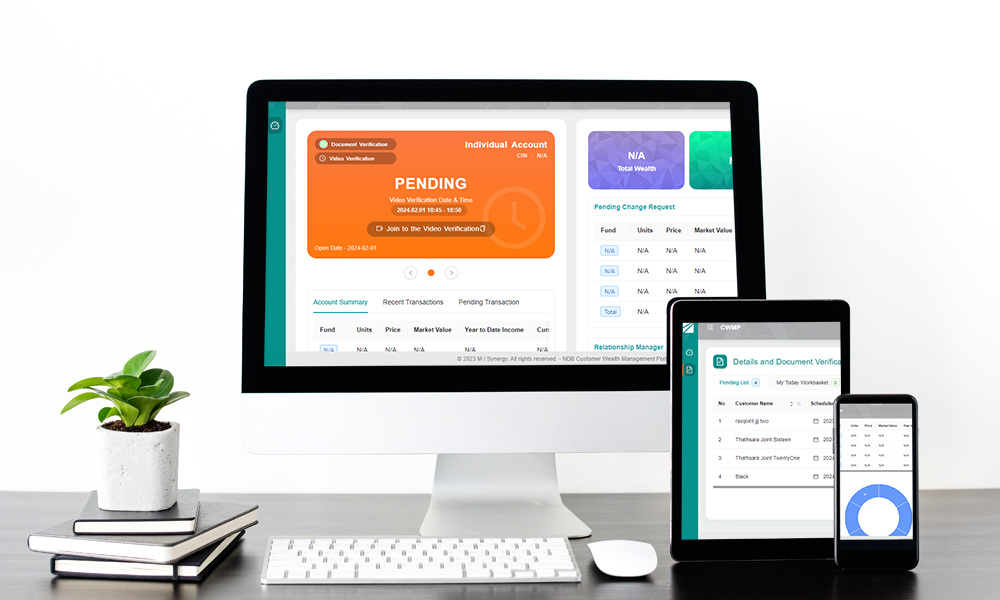

Introducing Master Communicator, the Omnichannel client communication portal engineered specifically for the unique demands of the wealth management industry. We empower your firm to build stronger, more transparent, and compliant client relationships in a digital-first era.

The Challenge: Fragmented Communication in a High-Stakes Environment

Client interactions are scattered across multiple platforms—a crucial investment update via email, a quick question on WhatsApp, and formal documents through a portal. This fragmentation creates risk:

- No Single Source of Truth: Lack of a unified record makes it difficult to track client instructions or preferences.

- Compliance Gaps: Regulators demand a complete audit trail of all client communications, which is nearly impossible to maintain across disjointed systems.

- Eroded Trust: Missed messages or forgotten conversations can damage the client-advisor relationship.

Our Solution: Unified, Secure, and Compliant Client Conversations

Master Communicator consolidates every client interaction into one powerful, secure platform.

- Omnichannel Engagement: Meet your clients where they are. Communicate seamlessly through social media, email, and SMS—all within a single, integrated portal. There is no need for clients to download a new app, ensuring effortless adoption.

- Fortified Security & Auditability: Our end-to-end secure architecture with role-based access ensures that sensitive financial data is protected. Every conversation is automatically logged, creating an immutable audit trail that is readily available for compliance reviews and dispute resolution.

- Structured yet Personalized Communication: Leverage pre-approved message templates for routine updates and regulatory disclosures to ensure consistency and compliance, while retaining the flexibility for personalized, free-format messaging for tailored advice.

- Preservation of Institutional Knowledge: Client communication history remains with your firm. This ensures seamless handovers between advisors and protects your business, ensuring client relationships are managed by the firm, not just an individual.

Why Master Communicator is the Choice for Leading Wealth Managers

- Build Unshakeable Trust: Transparency in all interactions strengthens client confidence.

- Ensure Regulatory Readiness: Be always prepared for audits with comprehensive logs and reporting dashboards.

- Enhance Operational Excellence: Streamline advisor workflows, reduce administrative overhead, and improve response times.

- Future-Proof your Practice: Engage a new generation of clients with the digital communication experience they expect.

Embrace the future of wealth management communication. Build trust, ensure compliance, and deepen client relationships with Master Communicator.